What would your reaction be if we told you that 47% of bank consumers are not engaging with you the way you think they are? And what would you say if we told you that by simply integrating Mobile Messaging throughout your customer journey, you would be able to better engage with those potential customers? Read on to learn more.

The world is evolving faster than ever, and the COVID-19 pandemic brought many of those changes here faster than expected.

Consumers changed the way they worked with businesses, with much of that interaction happening virtually. Because of that, financial Institutions sped up their investment in online tools such as their website and mobile app. However, the actual numbers are surprising.

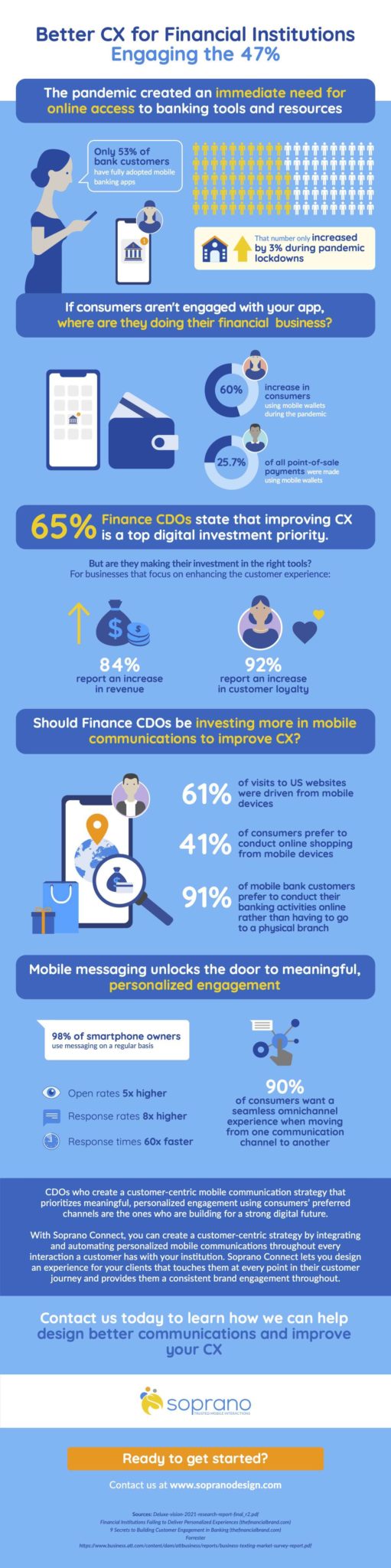

Despite the limited access to physical branches during a global pandemic, the Financial Brand reports that only 53% of bank customers have fully adopted mobile banking apps. The pandemic lockdowns, which anticipated accelerating adoption, only increased online banking adoption by 3%.

Reaching that 47% of banking consumers that no financial institution has yet reached has become like a hunt for lost treasure. The loot? More engagement with those customers that translates to new revenue and growth opportunities.

But you know that the financial sector is a crowded space, and at any moment, those neglected consumers will fall into the hands of the competition.

Traditional banks aren’t the only ones in the game. New mobile wallets, payment apps, fintech, and digital banks are coming to market all the time, offering users quick and easy alternative solutions.

Banking Chief Digital Officers (CDOs) should ask themselves: How do I make customers choose us over others? The financial market is flooded with similar services, so “with a better product” is not the answer (although it is also important!).

Let’s start thinking about them not as a percentage but as what they are: individuals. Engaging with them in a meaningful way and creating a positive Mobile Customer Experience will make you their first choice.

What is Mobile Customer Experience (CX)?

Customer experience (CX) focuses on the relationship between the company and the customer. It Is how organizations engage with consumers throughout the entire customer journey to deliver experiences that create satisfaction and loyalty.

CX involves every interaction point – from marketing and sales to transactions and customer service. Each of these touchpoints presents an opportunity to meaningfully engage with consumers or risk losing their business in a crowded, competitive market.

SOPRANO CONNECT FOR FINANCE: ELEVATE YOUR CUSTOMER EXPERIENCE

Where do people want to be reached? Through the channels they choose, their mobile phone. Receiving an SMS with an account alert or communicating with technical support via WhatsApp will make them choose you and stay with your business.

SMS in Banking, an essential step for Banks towards better CX

Before the pandemic, banks were already prioritizing to improve their most visible digital properties, such as apps and sites; and some banking consumers were already migrating to digital banking.

But moving from physical spaces to mobile banking apps isn’t quite enough. Mobile apps are an essential part of the package; however, there are significant risks in limiting CX investments to apps while neglecting other high-value engagement channels, like mobile messaging.

4 Reasons Why Financial Institutions should Invest in Mobile Messaging for CX

- SMS is already fully adopted

The data speaks for itself: 98% of smartphone owners use SMS regularly.

Today, everyone from the youngest to the oldest knows how to send and receive a mobile message. More importantly, it leaves no one out: you don’t need the latest mobile phone or the fastest Internet connection.

- Mobile Messaging increases not only revenue but also loyalty.

In an industry where multiple companies offer similar services, loyalty is critical. Financial institutions must ensure that their customers continue to choose them over others.

For businesses that focus on enhancing the customer experience, 84% report an increase in revenue and 92% increase in customer loyalty.

- Your messages are more likely to be successfully read.

The open rate of SMS is five times higher than traditional email, and response times are sixty times that of email.

Personalization can drive revenue growth — up to 15% significantly.

- Digital is the future; physical branches not what they used to be.

The days of waiting in lines to see a teller are long gone. Many consumers prefer to interact with banks via their mobile phones, and they are able to do almost anything virtually – from opening a new account to talking to a service agent.

Business Insider reports that U.S. Bank permanently closed approximately 25% of its physical branches in recent years.

But that lack of face-to-face contact doesn’t mean consumers don’t want to feel cared for and look after. Banks and financial institutions must look for new communication channels to meet the new needs of their consumers from a distance, and here is where mobile messaging becomes a vital part of the solution.

Soprano Connect, Advanced CPaaS to keep you connected to your customers

In this article, we talked about the importance of creating meaningful interactions with Mobile Customer Experience to reach new customers and gain loyalty.

How can businesses accomplish this? Soprano Connect is the solution for companies to ensure that they send the right information to the right person at the right time and in the right channel.

Having the right CPaaS solution allows big enterprises, government, and financial institutions to integrate and automate real-time communications channels in applications that customers already use to engage with them throughout the customer journey.

Want to learn more about Soprano Connect? Please feel free to contact us today.