Finance SMS Services

Engage your audience while driving productivity through a trusted SMS solution tailored for digital transformation in the banking and financial services sector.

A leading global CPaaS solution, proudly featured by

Use SMS for Customer Marketing

Consolidate our omnichannel platform with your existing CRM systems to send promotions, discount offers, and announcements.

Manage Account Alerts via SMS

Send automatic mobile reminders for due or late payments or alert account holders about important account information.

Prevent Phishing and Fraud

Soprano can help you with fraud-protection and SPAM compliance rules and regulations to ensure your customer experience and lists stay positive.

Finance transformation with mobile communication platform

Soprano’s trusted omnichannel communication platform enables you to create more efficient and faster communication throughout your financial ecosystem. The platform is built for scale, speed, and deliverability along with geo-redundancy to handle volume spikes and maintain high platform availability.

With the capabilities of real-time 2-way mobile interactions, it offers a truly seamless, personalized, superior customer experience across all digital channels – Voice, SMS, Email, RCS, WhatsApp, Interactive IP messaging.

Please complete the form and our team will get in touch with you.

“Soprano Design’s Whole of Government communications solution is the most comprehensive government/citizens communications platform available in this segment to date. This platform facilitates modular departmental use cases or broad-based agency notifications. It also meets security and compliance regulations, that can be customized by agencies or regions. While other CPaaS providers are offering piece meal offerings, Soprano Design’s platform will be well received for its consistency and orchestration capabilities.”

Courtney Munroe, Research VP, WW Telecommunications Research, IDC. February, 2020

Featured financial messaging use cases

Engage and reach securely and productively with a proven mobile messaging solution

Internal Incident Management

Soprano Connect allows you to send workers safety check messages to validate if a worker is safe, follow-up responses, and escalates if no responses are received depending on time rules.

Rapid Response

Trigger alerts from any web-enabled device, in or out of the office, at any time of the day or night and deploy time-sensitive information to the right people from wherever you are.

Communicate Richly & Securely

Share information quickly and securely during an incident with pre-set contact groups, updating key stakeholders about the situation and measures being taken.

Archive & Audit Mobile Conversations

Message logs and conversations are searchable and downloadable and our online portal provides detailed and configurable reports to fully audit mobile conversations.

B2C High-Volume Mobile Messaging

Create opt-in SMS account management and loyalty programs and use Soprano Connect to automate how you send reminders for payments due or late payments, announcements, account messages and increase response rates for promotional mortages.

Connect includes sophisticated tools for large-list management, multi-site deployments, permissions-based real-time reporting and high-volume performance.

SMS 2-Factor Authentication

Provide unique mobile security tokens to validate account holder identities with temporary one-time passwords.

SMS for Finance Marketing

Do a banking and financial transformation with a better customer-centric approach. Create a direct and personal relationship with account holders by integrating SMS within your existing CRM systems and enable your teams to send targeted messages to their customers.

Bank Account Alerts Via SMS

Send RSA 2048-bit encrypted mobile alerts notifying stakeholders and account holders of important account activity, transactions and payment reminders.

API-Integrated Mobile Messaging

Use our APIs to integrate Omnichannel messaging into your existing company IT systems. Soprano Connect can enhance your existing communications and systems with mobile interactions. Soprano Connect is used widely today as a complement to leading financial institution IT administration systems, CRM systems, and well as various industry alerting and facility IT systems.

Use a Smart API for Integration

Integrate our mobile solutions seamlessly into your existing IT and CRM systems. Enhance your existing processes and easily build mobile messaging into your workflows.

One-Time Passwords

Generate and send unique security tokens via SMS, to provide One-Time-Passwords as a second layer of authentication.

Integrate with Existing Security Systems

Our mobile enterprise messaging systems are compatible with RSA SecureID, F5, Citrix, IBM and other 3rd-party OTP systems that can be used when RSA hardware tokens aren’t feasible or desired.

Embrace Digital Transformation in Financial Services with Soprano Connect

Solutions for financial messaging services

Soprano Connect is a complete 2-way mobile messaging delivered through a single user interface for inbound and outbound messaging via email and SMS. It helps automate communication and workflow processes integrating with current IT systems throughout one o facility or multiple facilities.

B2C Mobile Alerts

Account Service Alerts

One-time Passwords

Critical Incident Management

System-Integrated Mobile Messaging

Mobile Team Collaboration

Remote Worker Communication

Customer Marketing Communication

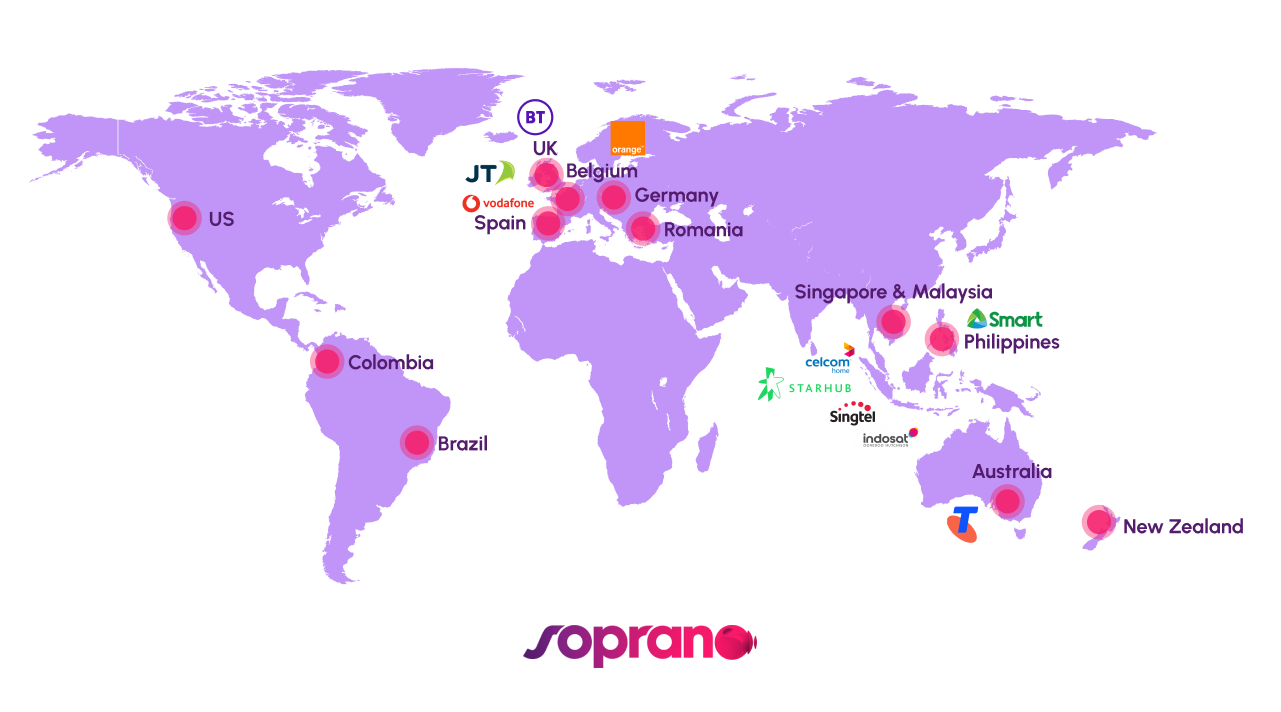

Soprano’s customers

Soprano Design has more than 4500 customers globally across APAC, EMEA, LATAM and the US.

Our customers range from large corporations to independent companies across every industry possible including Government, Healthcare, Finance, Education, Retail, Manufacturing and Logistics.

Soprano Connect is a leading communications platform-as-a-service (CPaaS) credited by IDC as a “Major Player” in CPaaS and by 451 Research as a “CPaaS Vendor to Watch” in 2021.

Start using SMS for Finance

Soprano’s trusted mobile communication platform enables you to create more efficient and faster communication throughout your financial ecosystem. The platform is built for scale, speed, and deliverability along with geo-redundancy to handle volume spikes and maintain high platform availability.

With the capabilities of real-time 2-way mobile interactions, it offers a truly seamless, personalized, superior customer experience across all digital channels – Voice, SMS, Email, RCS, WhatsApp, Interactive IP messaging.

Please complete the form and our team will get in touch with you.

Guides and Resources for Financial Messaging Services

10 Reasons about the importance of communication in banking

Discover ten ways finance companies are evolving digitally to keep up with customer expectations in our latest infographic.

The age of the customer in financial services

Webinar: Hear from leading financial services industry experts insights into CX challenges and mobile connectedness in the finance space.

More information about Use Cases for Financial

Learn about the benefits from improved multi-channel communication in banking.

The digital transformation in financial services

Discover the radical leaps in financial services technology that has revolutionised how we interact and communicate.